Have you ever wondered how decentralized finance works? If so, you’re in luck! In this blog post, we’ll be exploring the inner workings of MakerDAO, a revolutionary platform in the world of cryptocurrency. Join us as we delve into the complexities of this innovative system and uncover the secrets behind its success. Strap in, because we’re about to embark on a journey into the exciting world of MakerDAO.

Introduction to MakerDAO

MakerDAO is a decentralized autonomous organization that operates on the Ethereum blockchain. It provides a platform for users to generate the stablecoin Dai by locking their cryptocurrency assets as collateral. This process is made possible through the use of smart contracts, which ensure transparency and security in the issuance of Dai.

One of the key components of MakerDAO is the Dai stablecoin, which is pegged to the US dollar. This stability is achieved through a system of checks and balances, including the use of decentralized oracles to provide real-time price feeds for various cryptocurrencies. Users can leverage their collateral to generate Dai, which can then be used for various purposes such as trading, lending, or making purchases. MakerDAO also features a governance token called MKR, which allows holders to participate in the decision-making process for the platform.

Understanding the Stability Mechanism

In order to understand how MakerDAO works, it is crucial to grasp the stability mechanism behind it. The stability mechanism ensures that the value of the stablecoin (DAI) remains at $1 USD. This mechanism consists of several key components:

- Collateralized Debt Position (CDP): Users lock up their Ethereum as collateral in a smart contract to generate DAI.

- Liquidation: If the value of the collateral drops below a certain threshold, it is liquidated to protect the stability of DAI.

- Stability Fee: Users pay a stability fee to generate DAI, which helps regulate the supply and demand of the stablecoin.

- Governance: MakerDAO holders vote on changes to the system, ensuring decentralization and security.

Overall, the stability mechanism of MakerDAO is designed to maintain the peg of DAI to the US dollar through a series of decentralized and automated processes. This ensures the stability and reliability of the stablecoin in the volatile cryptocurrency market. By understanding how these components work together, users can participate in the MakerDAO ecosystem with confidence and trust in the system.

| Component | Description |

|---|---|

| CDP | Users lock up Ethereum to generate DAI. |

| Liquidation | Collateral is liquidated if value drops below threshold. |

| Stability Fee | Users pay fee to regulate supply and demand of DAI. |

| Governance | MakerDAO holders vote on system changes. |

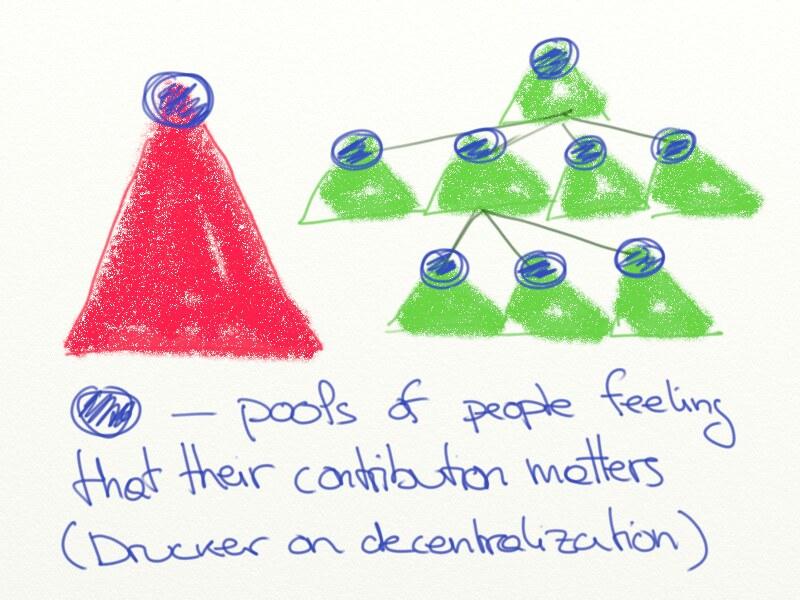

Decentralized Governance and Future Developments

In MakerDAO, decentralized governance is achieved through the use of smart contracts on the Ethereum blockchain. These smart contracts govern the creation of the stablecoin Dai, as well as the governance token MKR. Holders of MKR tokens have the ability to vote on proposals that affect the MakerDAO system, such as changes to the stability fee or collateral types accepted.

As MakerDAO continues to develop, future developments may include enhancements to the governance process to make it more efficient and transparent. This could involve improvements to the voting system or the addition of new features to further decentralize decision-making within the MakerDAO ecosystem. Ultimately, the goal of MakerDAO is to create a decentralized and autonomous system that is governed by its users, ensuring the stability and sustainability of the Dai stablecoin.

To Wrap It Up

In conclusion, after delving into the intricacies of how MakerDAO works, it is evident that the protocol offers a revolutionary approach to decentralized finance. By utilizing smart contracts and crypto-collateralization, MakerDAO provides a stablecoin solution that is both transparent and resilient. As we continue to witness the evolution of blockchain technology, MakerDAO stands as a beacon of innovation in the world of decentralized finance. We hope this video has shed some light on this fascinating topic and sparked your curiosity to learn more about the future of finance. Thank you for watching!